Background

Background:

-October 2022: Apple announces a new venture for the company: a high-yield savings account, followed by mostly silence

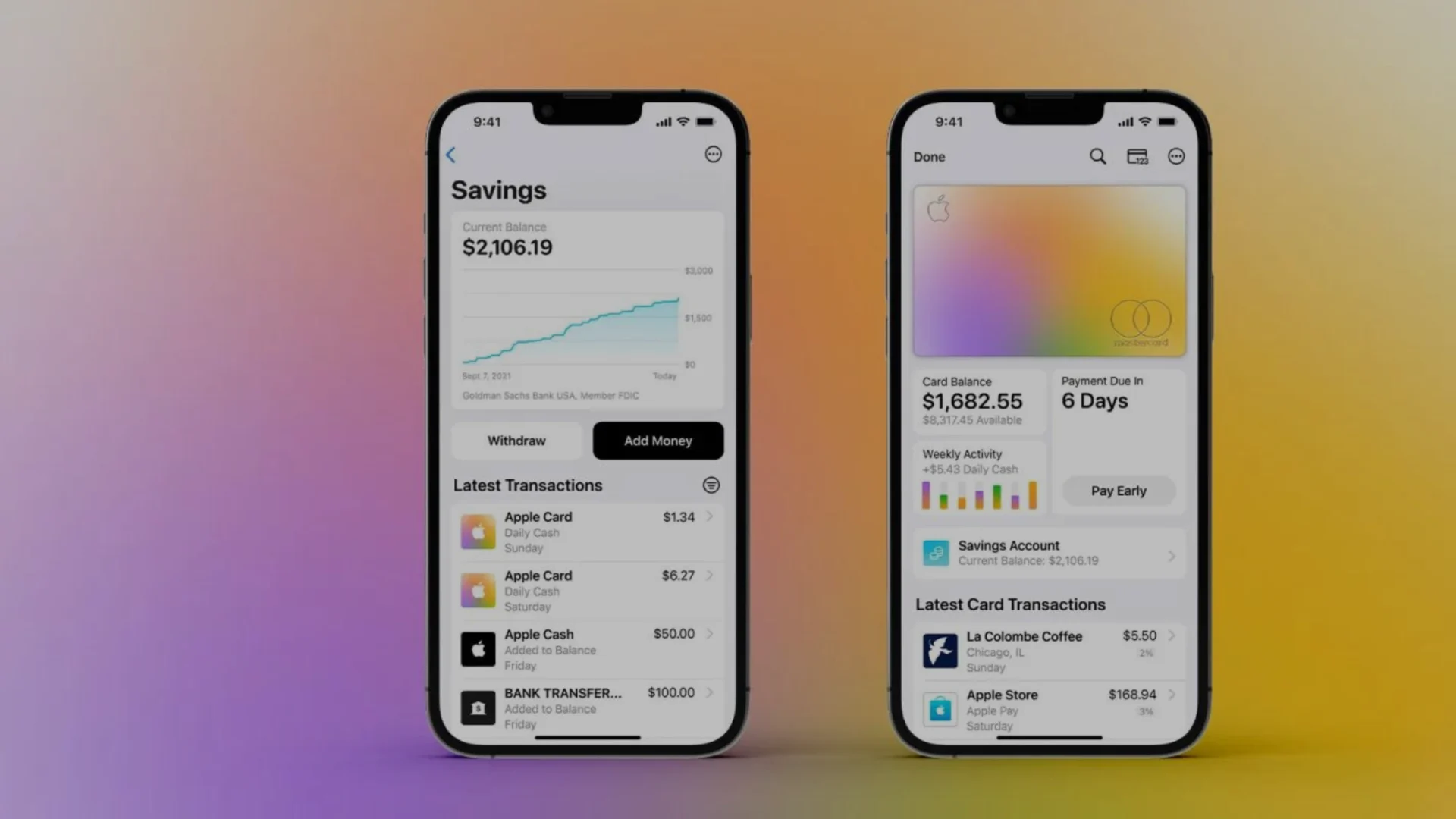

-April 17th, 2023: Apple quietly launched their new offering, giving a 4.15% APY to any Apple Card holders through a partnership with Goldman Sachs

-April 21, 2023: Deposits into new Apple Savings Accounts top $1B

-August 2, 2023: Deposits in Apple Savings Accounts top $10B

-December 2023: Apple increases its savings account to 4.25% after lagging behind most of the competition

-Early January 2024: Another increase puts the Apple Savings Account to 4.35%

-January 27, 2024: Apple Savings Accounts are upgraded for deposited funds to 4.50%

What is Apple doing?

In 2022, when the iPhone Maker announced that they would be offering a savings account, it seemed like a wild move that had little to no connection to their core business. Apple Pay, launched in 2014, was the closest they had come to banking, and that was out of necessity due to a sweeping increase in the use of phones as a payment form. Apple was able to profit from the interest that customers owed by adding the Apple Card as a safety net for those who didn’t have enough in their accounts. The card fit well in the economy as consumer debt, a significant portion of which is held as credit card debt, was nearing its all-time high.

Think debit versus credit card. Apple Pay was intended as a debit card to take existing money from your account, while the Apple Card was intended to make purchases on credit that can be paid for later with interest. All of this is good and well, but what happens if people pay off their cards right away? No interest is accrued, meaning no interest can be collected, meaning no additional money for Apple.

Now, keep in mind that all of these ideas are in the name of new income-producing business opportunities. As a publicly traded company, they have to find new ways to make more money for the shareholders and increase the market cap, or people will start to ask a lot of questions.

With that in mind, and the understanding that Apple wasn’t raking in big bucks from the Apple Card, they needed an alternative. Something that could do one of two things: 1) increase their income directly, or 2) directly increase their ability to make money. Enter the Apple Savings Account.

You might be wondering how a savings account that you get paid 4.5% helps Apple make money, but Apple is always two steps ahead. If you could create a way to spend money that wasn’t yours, to make extra money, and pay out a portion of it as a thank you, wouldn’t you? Let’s add some numbers to this to help paint the picture here.

Imagine your friend lending you $100. You use that full amount to buy all the supplies you need to handle catering an event for a small gathering with your catering company. You tell the client that it’s going to cost $200 for you to cater the event; payment is due at the close of the event. You have an incredible event; get your $200, and then go back to the friend and pay him the original amount he gave you plus a small fee as a token of your appreciation.

You now borrowed $100 to make $200 and paid a fee for the loan – say 4.5%. You give your friend $104.50 and walk away with $95.50 after 2 hours of work. This is exactly what Apple does, but en masse.

Look at the timeline from above – On April 21, 2023 they had already received $1B in money from customers that were only looking for a 4.5% fee for the use of their money. While the customers feel like they are getting a steal because they are getting 4.5% on money that may otherwise collect .01% in a traditional savings account, Apple has free range of the use of the money so long as they always pay back their customers on time.

So what does Apple do with $1B in money from customers? Well, think about it like a business. What expenses would you pay for with someone else’s money, if you knew you could make more money by doing it? For Apple, it would most likely be funneling the money back into their core business – iPhones, Computers, iPads, Watches, etc.

They can use their “loaned” money from these savings accounts to fund the building of millions of products, selling them at a roughly 137% markup* (based on numbers from the iPhone 14 Pro Max), and providing a small thank-you fee to the customers who paid their fees for them.

How is that legal, you might ask? Isn’t that stealing? When you signed up for the savings account, you agreed to let them do whatever you wanted them to do with your money, so long as they kept their promise of giving you 4.5% at the end of each month. You win, and they win based on the agreed-upon terms on which you entered.

Now, you’ll never be able to truly see what the money is used for as an exact one-to-one, but that is for Apple to decide and you to wonder while collecting your 4.5%. What just happened here is not revolutionary by any means, as this is pretty much an exact description of the modern banking system, but what’s revolutionary is the technology brand associated with it.

Have you noticed any other companies starting to do this in recent months? I know for a fact that I have seen multiple big time car manufacturers do this in lieu of using outside banks and credit agencies to help people purchase their vehicles. While cars and iphones are just a small portion of it, you should expect to see this happen more often with high-ticket (expensive) products.

The question really then becomes, why wouldn’t everyone do this? The truth is that it’s not easy by any means. You are essentially setting up your own bank which requires insane amounts of legal approvals, FDIC Security approvals, banking regulations you must follow and most importantly, the associated risk. The risk of potentially losing money comes at a very high cost and the risk of wasting time and resources building something that people won’t use. If a company like Apple, which has at least one product in 60% of the world’s hands, can create this product and get to you first, why do you need another company to offer you the same thing?

The world of High-yield banking is not a new concept, but it is relatively new to the general population who oftentimes find themselves saving money in a traditional account getting pennies on the dollar. The idea of making $50-$250 per month for just placing your money into a different account is appealing to a lot of people.

Why does Apple keep increasing the amount of money they are paying out?

The amount they are paying out continues to increase for a few reasons. First and foremost is to be competitive. The 4.15% was a great introduction to the market and proof-of-concept, but to really draw an audience of loyal bankers from their current establishment they need to raise the stakes above what the competition is doing. Additionally, that proves to us as consumers that the agreement is working out so well that Apple happily increases the APY because they want to keep customers satisfied with the mutually beneficial relationship. While the increases may stay at 4.5% for a while, on a $10,000 savings account in the last 9 months, the increase represents an 8% improvement on the ROI (return on investment) for consumers and in the world of banking, that is huge.

Before you go run out and sign up, please keep in mind a few things:

-First and Foremost, this was not written to be financial advice. This is purely educational content on what Apple is doing outside of their core markets to help them win big.

-Second, at the time of writing the 4.5% APY is paid out monthly, but compounds daily. That means if you insert additional money in the middle of the month, it will start to gain interest the very next day.

-The FDIC Insurance covers up to $250K, so anything under that is fully insured, and

-There are no monthly fees or minimum requirements so the barriers to entry are very minimal.

-Acceptance for both the Apple Card and the Apple Savings Account are conditional and we cannot guarantee acceptance.

Unfortunately for all your Android users, you won’t be so happy about this, but this offer is exclusive to only iPhone users that already have an Apple Card. If you don’t have an Apple Card, you can sign up easily by visiting: Apple Card Sign Up.

Once you have done that, make sure you are operating on the most updated version of iOS and you will be able to find the savings account application in your Apple Wallet. Complete that process and you are on your way to earning a cool 4.5% on all your Apple Savings Account deposits.

With one simple addition to their business, Apple rewrote the handbook on the relationship between businesses and banks. Keep an eye on the big banking institutions to see how they respond; it should be a good ride.